In 2026, however, that script has been flipped on its head.

The economic reality of the last 18 months—marked by currency devaluation and hyper-inflation—has fundamentally changed the math of construction. With the price of essential materials like cement, reinforcement bars (iron rods), and finishing fittings hitting all-time highs, the “savings” of self-building have largely evaporated, replaced by the risk of open-ended costs.

If you are sitting on the fence, wondering whether to start a building project or purchase a finished home, you need to see the numbers. This guide provides a brutal, honest cost breakdown to help you protect your capital.

The Data: The Skyrocketing Cost of “Starting from Scratch”

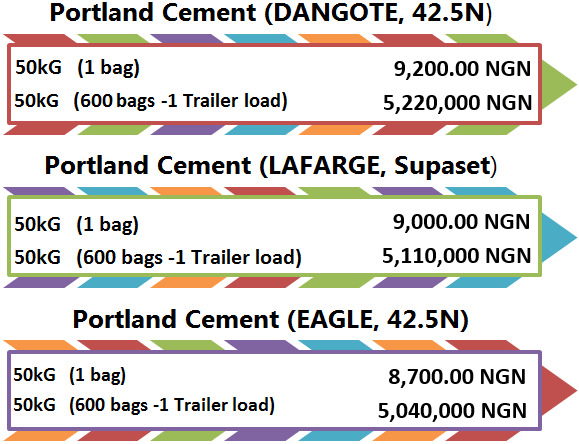

Let’s look at the raw numbers. The cost of individual building materials has surged dramatically, meaning a budget drafted in 2024 is now completely obsolete.

- Cement: A 50kg bag of cement, once a stable commodity, has fluctuated between ₦9,500 and ₦11,000 in major cities.

- Iron Rods: Essential for any storey building (duplex/terrace), the cost of a ton of 16mm iron rods has climbed to between ₦1,100,000 and ₦1,300,000.

- Finishing Materials: Tiles, sanitary ware, and electrical fittings—most of which are imported—have seen prices double due to the exchange rate.

The “Inflation Tax” on Self-Building: When you build yourself, you are exposed to these daily price fluctuations. A project planned to take 12 months often stretches to 24 months. In that time, the price of your roof might increase by 40% before you get to that stage. This is the “Inflation Tax”—the money you lose simply by taking time to build.

The Hidden Risks of the “Owner-Builder” Route

Beyond the material costs, self-building in the current climate carries unique risks that “buying” eliminates:

- The “Omo Onile” Factor: In many developing areas, settling community levies and dealing with disruptions can add millions of Naira (and immense stress) to your project—costs that are rarely budgeted for.

- Theft and Wastage: Without professional site management, material theft by workers and wastage can account for 15-20% of your total budget.

- Stalled Projects: The landscape is littered with uncompleted buildings. Owners start with good intentions, but inflation eats their budget, leaving the capital trapped in an unlivable, half-finished structure.

The Smarter Alternative: Why “Buying” (Especially Off-Plan) Wins in 2026

Given these harsh realities, purchasing a property—specifically an Off-Plan or Newly Completed home—has become the financially superior option for many investors. Here is why:

1. Economies of Scale

Developers like MiraEmma Properties don’t buy cement by the bag; we buy by the trailer. We don’t buy iron rods by the ton; we buy by the container.

- The Math: We secure materials at wholesale prices that are 20-30% lower than what an individual buyer pays in the open market. This allows us to deliver a finished home at a price point that is often lower than what it would cost you to build the same structure yourself.

2. Locking Down the Price (The Off-Plan Hack)

When you buy an off-plan home, you agree on a price today.

- If the price of cement doubles next month, you don’t pay extra. The developer absorbs that risk.

- You effectively “lock in” your construction cost at today’s rates, insulating yourself from future inflation.

3. Immediate Asset Value

When you buy, you get a tangible, tradeable asset. You can move in immediately (saving rent), or put it on the market to earn rental income. A self-build project consumes cash for years before it starts giving anything back.

The Verdict: Protect Your Peace and Your Pocket

Unless you are a construction professional with direct access to wholesale materials, the era of “saving money by building yourself” is largely over. The risks of inflation, theft, and stress now outweigh the potential margins.

In 2026, the smart money is on certainty.

At MiraEmma Properties, we offer verified, high-quality homes where the price you see is the price you pay. No stories, no price hikes, no “Omo Onile” drama. Just a key to your new home.

Stop calculating the price of cement. Start calculating your return on investment.