Imagine being offered a brand new, luxury 4-bedroom terrace duplex in a prime district for N90 million. You hesitate. Eighteen months later, that exact same house is completed, painted, and put back on the market. The new price? N150 million.

You just witnessed the power of Off-Plan Investment.

In the Nigerian real estate market, the “Early Bird” doesn’t just catch the worm; they catch millions of Naira in instant equity. Buying “off-plan” (purchasing a property while it is still under construction or just a design on paper) is the single most effective way for smart investors to acquire luxury real estate at a massive discount.

But let’s address the elephant in the room: Fear.

We have all heard the horror stories. The developer who collected money and vanished. The project that stalled at the foundation level for five years. The “luxury estate” that ended up looking nothing like the 3D brochure.

This fear keeps many people poor. They insist on waiting for “brick and mortar” before they pay, unknowingly paying a 40% “Safety Tax” for that privilege.

What if you could have the best of both worlds? What if you could secure the low off-plan price and guarantee the safety of your funds?

This guide is your playbook. We will explain exactly why off-plan is the wealth-builder’s secret weapon and give you a rigorous 5-Point Safety Checklist to ensure you never get burnt.

The “Math” Behind the Magic: Why is Off-Plan Cheaper?

Why would a developer sell you a house for N90m today when they know it will be worth N150m next year? Are they being generous?

No. They are buying Speed and Capital.

- Zero Interest Financing: By selling a few units early, the developer raises cash to build without taking expensive bank loans (which currently come with 30% interest rates). They pass those savings on to you.

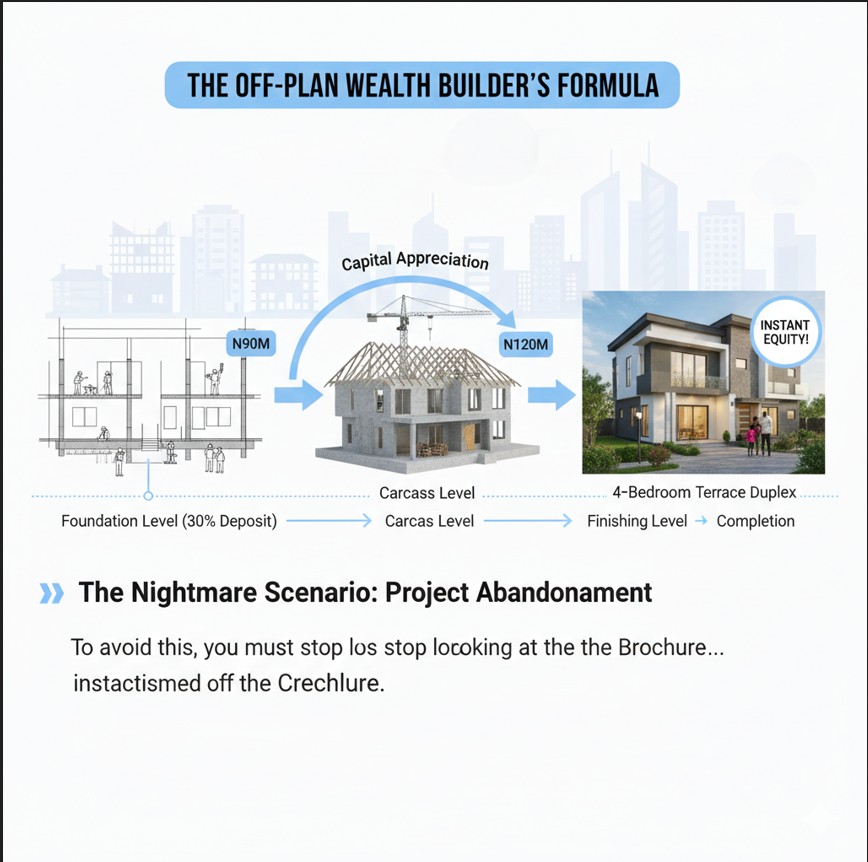

- Capital Appreciation: As the building rises, so does the value.

- Foundation Level: You buy at N90m.

- Carcass Level (Roofing): Value rises to N120m.

- Finishing Level: Value rises to N135m.

- Completion: Value hits N150m. By entering at the foundation level, you ride this wave of appreciation all the way to the top.

The Nightmare Scenario: Project Abandonment

The biggest risk in off-plan is Execution Risk. In 2026, with the cost of cement and iron rods fluctuating wildly, many inexperienced developers run out of money halfway through a project. They under-budgeted, spent your deposit on a fancy car, and now the site is quiet.

To avoid this, you must stop looking at the Brochure and start looking at the Business.

The 5-Point “Safety First” Checklist

Before you commit millions to an off-plan project, you must conduct this forensic audit.

1. The “Track Record” Test (Past Performance)

Never be a developer’s “Guinea Pig.”

- The Question: “Show me what you have built and delivered before.”

- The Verification: Don’t just look at pictures. Go to their previous sites. Are people living there? Is the paint peeling after 6 months? Did they deliver on time? A developer who has delivered 5 estates in the past is 95% likely to deliver the 6th one.

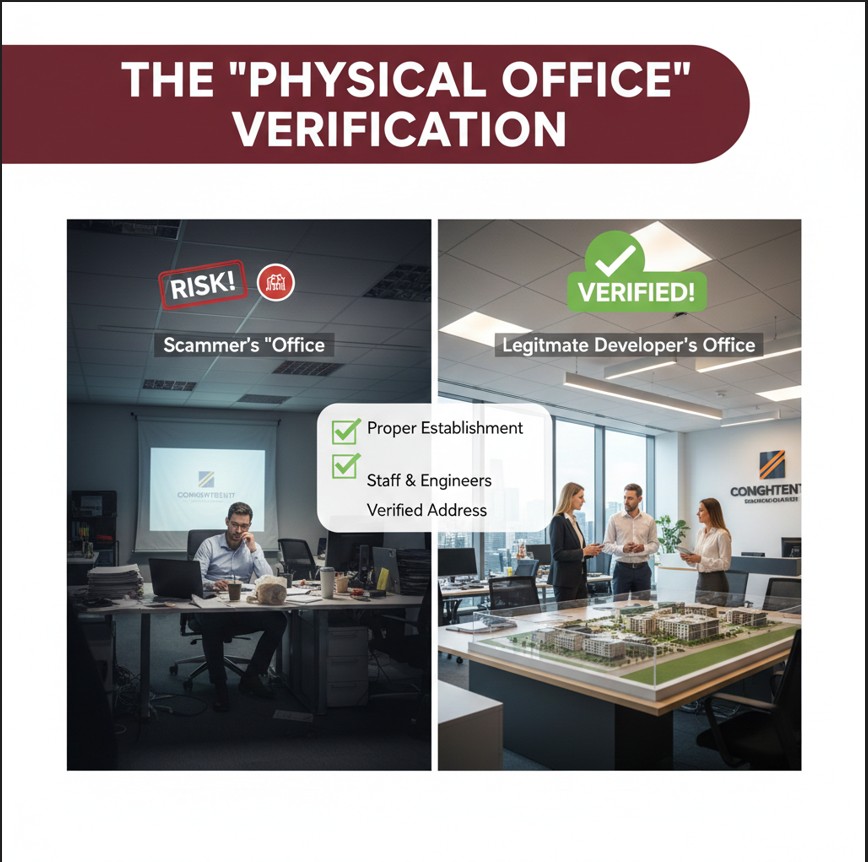

2. The “Physical Office” Verification

Scammers live on Instagram. Real businesses have addresses.

- The Strategy: Visit their corporate office. Is it a rented shared workspace or a proper establishment with staff, accountants, and engineers? A substantial physical presence shows they are not planning to disappear overnight.

3. The “Title” Check

You cannot build a castle on sand.

- The Verification: Ask for the land title documents before you pay for the house. If the developer doesn’t own the land (or doesn’t have a valid Joint Venture agreement), they have no right to sell you a house on it. Verify the C of O at the Land Registry.

4. The Contract Clauses (Delivery & Default)

Read the fine print. A good Contract of Sale protects both parties.

- Look for:

- Delivery Date: Is it clearly stated?

- Default Clause: What happens if they fail to deliver? Is there a refund policy with a timeline?

- Price Lock Clause: Ensure the contract states that the price you agree on is fixed, regardless of inflation. You don’t want them coming back for “extra money” for cement later.

5. The “Milestone” Payment Structure

Never pay 100% upfront if you are nervous.

- The Strategy: Ask for a milestone-based payment plan.

- 30% Deposit.

- 20% at Decking.

- 20% at Roofing.

- Balance at Completion.

- This ensures the developer only gets your money when they do the work. It keeps them hungry and accountable.

Why MiraEmma Properties is the “Safe Haven”

At MiraEmma Properties, we understand that trust is the most expensive currency in Nigeria. That is why we have built our off-plan model on Transparency and track Record.

- We Deliver: We have a portfolio of completed projects you can inspect today.

- We Verify: We don’t start a project until the land title is perfected.

- We Communicate: Our clients receive monthly video updates from the site, so you can watch your investment grow from anywhere in the world.

Don’t let fear stop you from building wealth. Let “Verification” be your shield.